Struggling with yourE-commerce Finances?

We Simplify VAT, Taxes and Bookkeeping for Online Sellers.

Trusted by Thousands of E-commerce Sellers

Comprehensive Solutions for

E-commerce Sellers

We specialize in accurate and timely bookkeeping for online businesses, ensuring your financials are always up-to-date & compliant.

Simplify everyday business tasks.

Because you’d probably be a little confused if we suggested you complicate your everyday business tasks instead.

Reporting

Instant Access to Financial Reporting

Get real-time reports that help you stay on top of sales, profits & tax obligations—so you can make smart decisions faster.

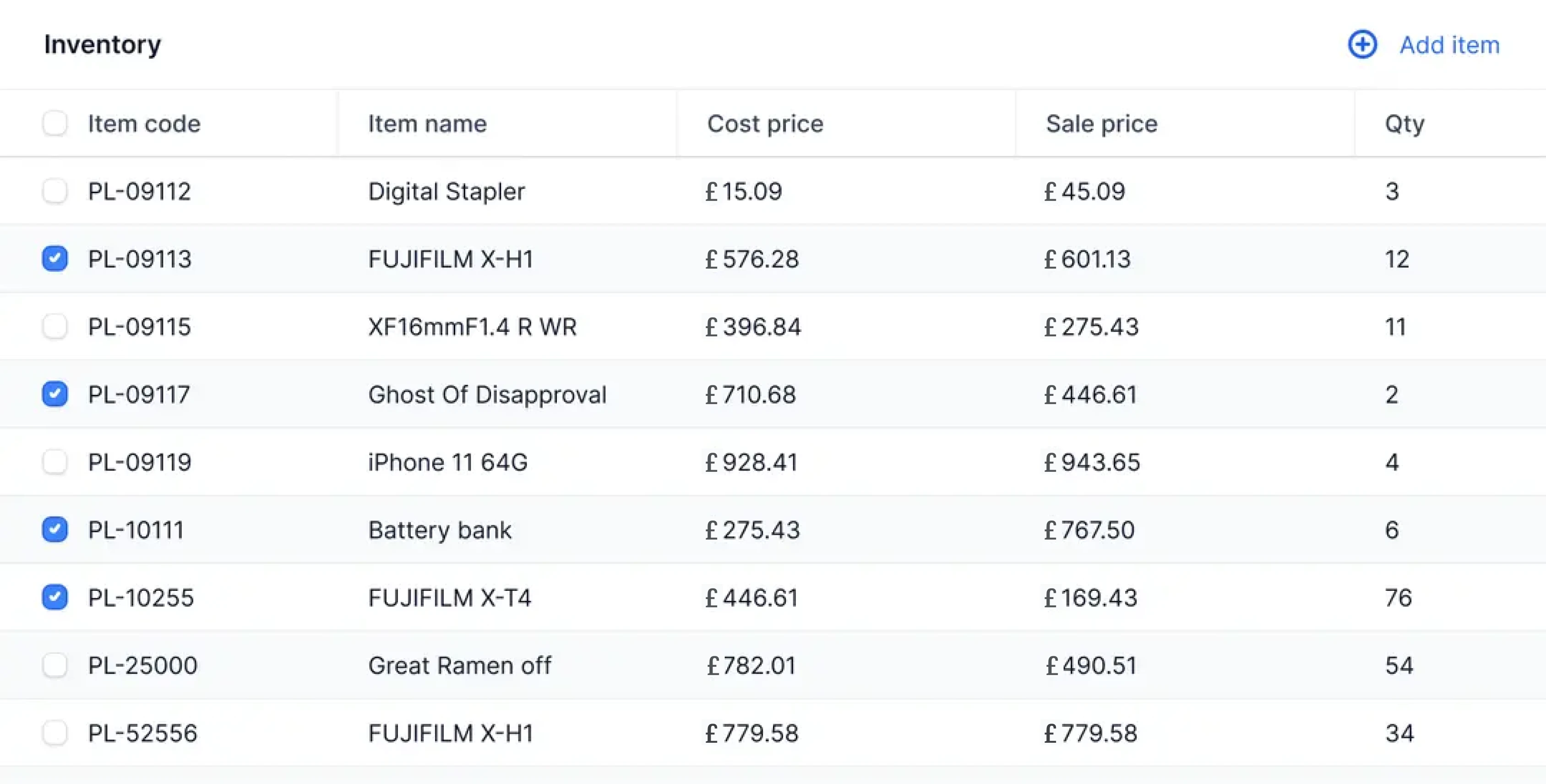

Inventory

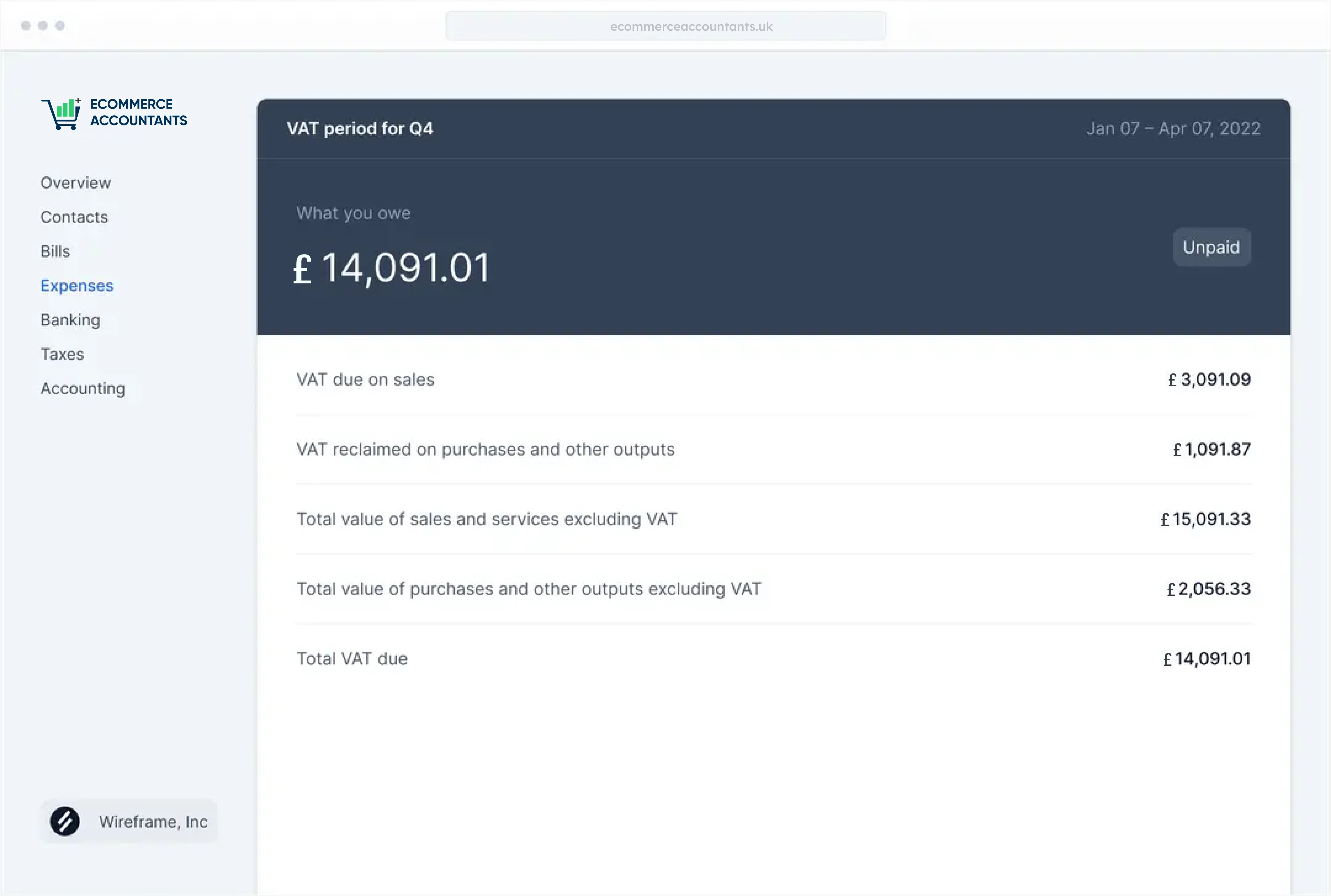

VAT & Tax Filing Made Easy

Never miss a tax deadline again. We manage VAT filing & taxes to ensure your business is always compliant.

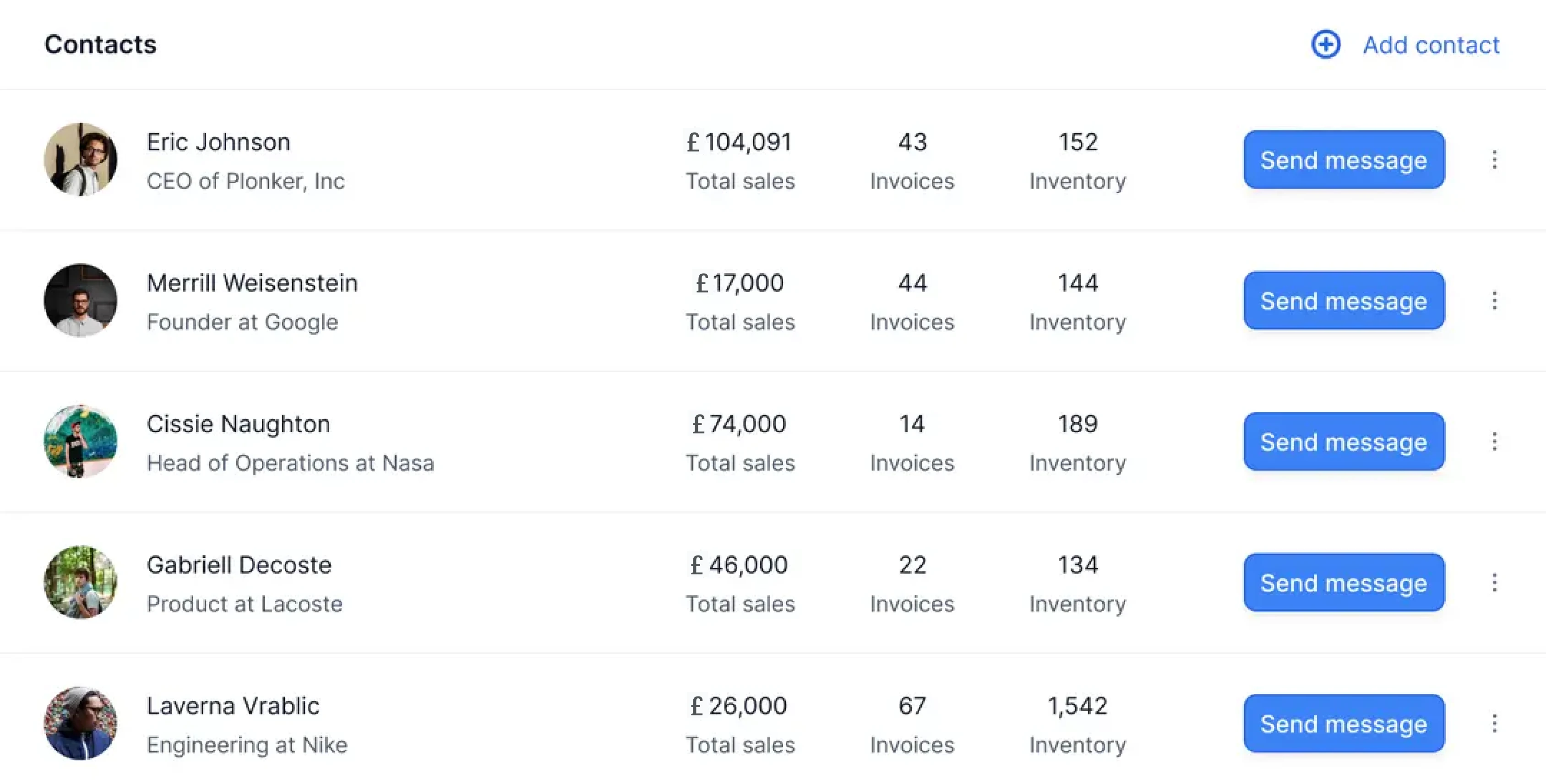

Contacts

24/7 Expert Support

Access support whenever you need it—because your business doesn’t stop & neither do we.

Instant Access to Financial Reporting

Get real-time reports that help you stay on top of sales, profits & tax obligations—so you can make smart decisions faster.

VAT & Tax Filing Made Easy

Never miss a tax deadline again. We manage VAT filing & taxes to ensure your business is always compliant.

24/7 Expert Support

Access support whenever you need it—because your business doesn’t stop & neither do we.

Future-Proof Your

E-commerce Finances

From VAT headaches to tax season panic, our e-commerce accounting services simplify your life. With automated VAT filing, real-time tax reports & expert 24/7 support, we handle your finances.

Claim Your Free Trial NowSuccess Stories from Our Clients

Here’s How We’ve Helped E-commerce Businesses Like Yours:

The free software integrates smoothly with my eBay and Etsy shops, making accounting simple. 24/7 support whenever I need it is a huge bonus.

Sophie L.eBay & Etsy Seller

The 24/7 support team at ecommerceaccountants is a lifesaver. I can always get help when I need it & they’re knowledgeable about e-commerce-specific tax issues.

Jessica F.Online Business Owner

Ecommerceaccountants made VAT filing painless for my Amazon FBA business. Their system automatically calculates everything and I never miss a deadline. It’s a game-changer!

John D.Amazon FBA Seller

Before, I had to manually update my books. Now, ecommerceaccountants integrates with my store, automatically syncing and keeping everything up to date.

Erin PowlowskiCOO at Armstrong Inc

Managing tax filings for my Shopify store used to take hours. Now, it’s seamless. I’m saving time & staying compliant, all thanks to ecommerceaccountants.uk.

Sophie M.Shopify Store Owner

The financial reports provided by ecommerceaccountants are clear and easy to understand. Now I can track my profits & expenses without stress.

Carla B.Online Store Owner

Transparent Pricing for

E-commerce Sellers.

No matter your business size, we have the right plan to simplify your accounting.

Starter

Perfect for new e-commerce sellers.

$9

- Automated VAT Filing for small businesses

- Connect up to 2 bank accounts

- Track up to 10 expenses per month

- Basic bookkeeping for e-commerce transactions

- Export up to 3 reports per month

- 24/7 support

- Email support for quick queries

Small business

For growing e-commerce businesses.

$15

- Automated VAT & Tax Filing for e-commerce sales

- Connect up to 5 bank accounts

- Track up to 50 expenses per month

- Real-time financial reports

- Export up to 12 reports

- Automatic bank reconciliation

- Track in multiple currencies

- Integration with Amazon, Shopify, eBay & more

- 24/7 support

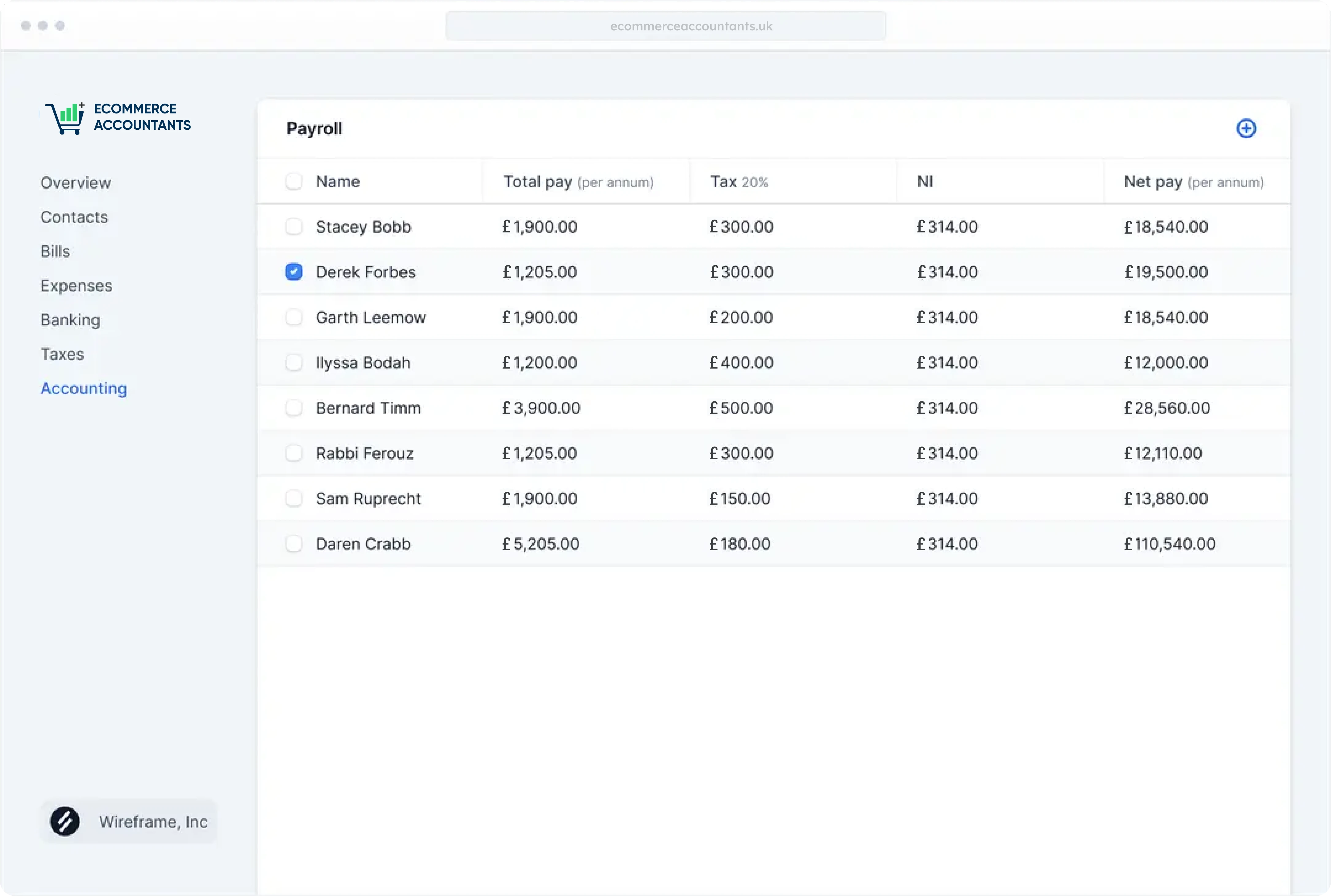

Enterprise Plan

For high-volume e-commerce businesses.

$39

- Automated VAT & Tax Filing for large businesses

- Bulk reconciliation of transactions

- Track up to 200 expenses per month

- Advanced financial reports & customized insights

- Export up to 25 reports, including TPS

- Integration with multiple e-commerce platforms

- Priority 24/7 support with dedicated accountants

- Payroll management support for teams

Frequently Asked Questions

Got questions about e-commerce taxes, VAT, or accounting? Check out our FAQs or reach out to our expert team for help.

Does ecommerceaccountants handle VAT filing for my online store?

Yes, our service automates VAT filing for all e-commerce platforms, ensuring your business stays compliant with UK tax laws.

What support is available if I need help?

We offer 24/7 support via chat or email, so you can get help with anything from tax queries to financial reports, no matter the time.

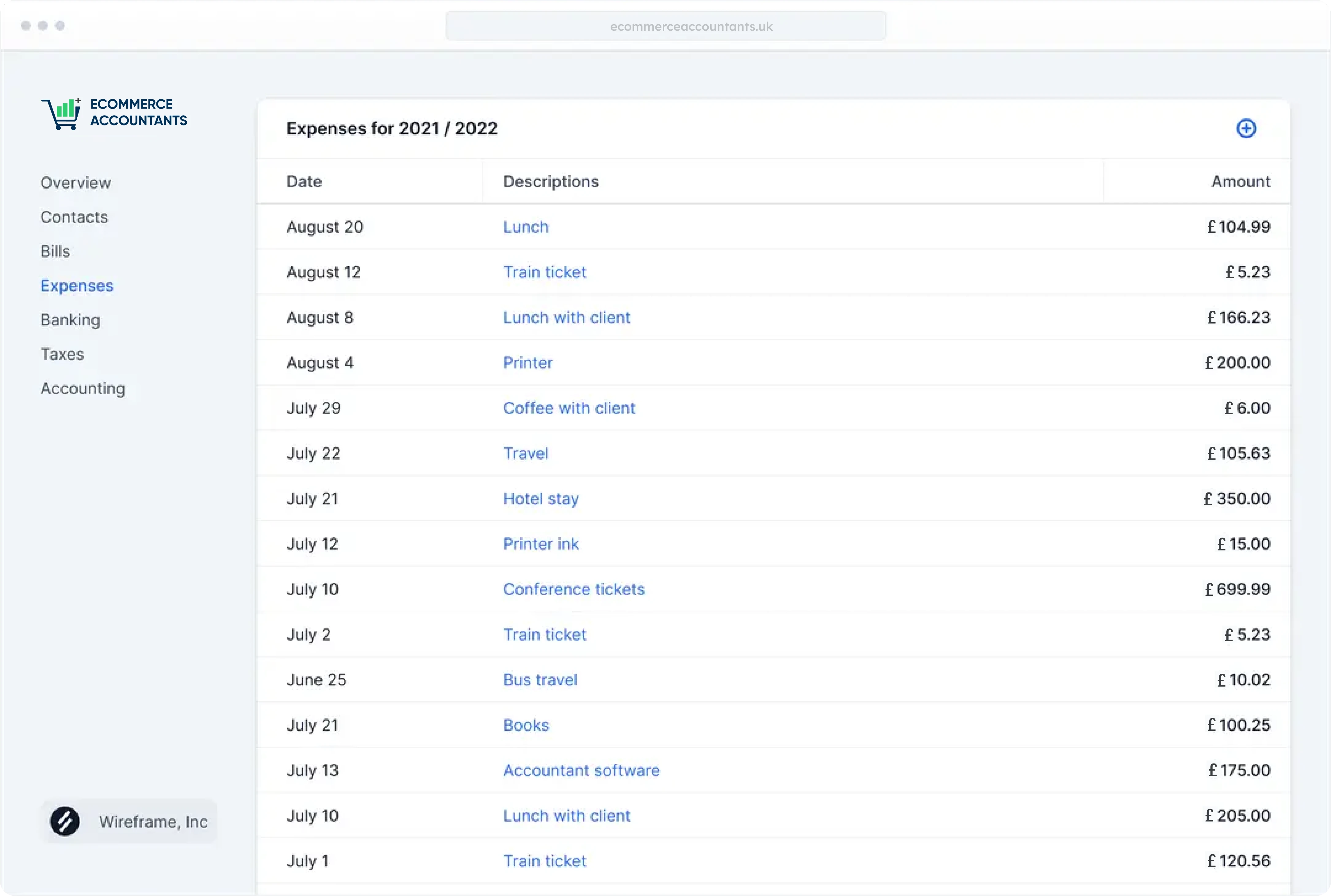

How does your accounting software help me track expenses?

Our software lets you easily track expenses by automatically categorizing and syncing your business transactions from multiple platforms.

How secure is my financial data?

We use bank-grade security to protect your data, with encrypted connections & regular security audits to ensure your financial information is safe.

How does ecommerceaccountants integrate with my e-commerce platform?

We offer seamless integration with platforms like Amazon, Shopify, Etsy & eBay, so your transactions are automatically synced for accurate bookkeeping.

Can I use ecommerceaccountants for my e-commerce taxes?

Yes, we provide automated tax filing for e-commerce businesses, covering VAT, income taxes & more to keep your business compliant.

What happens if I have multiple online stores?

No problem! Our service allows you to track multiple stores, each with their own financial records, integrated seamlessly into one account.

What is included in your reporting feature?

You’ll get real-time financial reports, including profit and loss statements, VAT reports & monthly transaction summaries to help you make informed decisions.

Can I integrate my business bank account with your system?

Yes, our software supports bank account integration to automatically import transactions & reconcile your books without manual input.

Is your service suitable for businesses of all sizes?

Yes, we offer flexible plans designed for small businesses, growing e-commerce stores & large enterprises, with the features you need at every stage.